Before wholesaling houses, reviewing a few successful case studies can help.” Such case studies offer the foundational knowledge you will need to make wise decisions when wholesaling.

My First Wholesaling Case Study

I have closed on many real estate deals in the past. None, however, came close to the cash flow and increased profits I saw with real estate wholesaling. The advantages of not having to finance and bear renovation costs made the business much more seamless, as well.

Wholesaling houses offers the luxury of making deals without investing any money, while still making a profit. Let me explain.

The Details of This Wholesaling Deal

Being successful in wholesaling houses is all about creating and maintaining relationships. It is also about having great communication and marketing skills. A friend of mine, an inheritance lawyer, kickstarted my path to wholesaling when he reached out to me about an available contract.

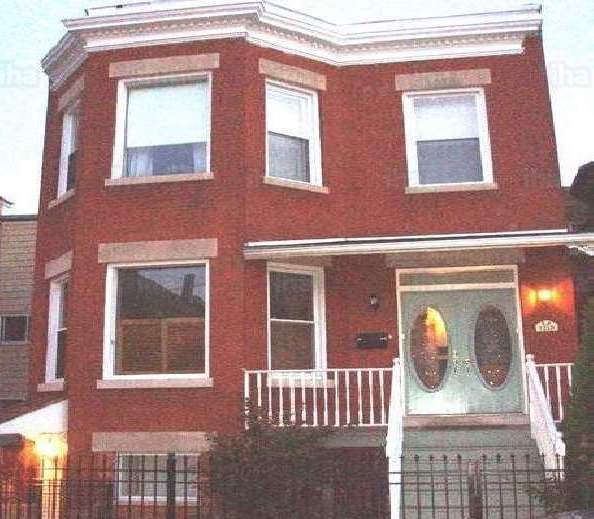

My friend knew that I was in real estate. He thought that I had enough cash and was looking for good deals. His client, a teacher, was looking to sell an inherited family property in Chicago, following the death of her father. She was a foster parent and needed quick cash to take care of her child.

Although my friend was looking to help me out, I could not afford to buy the rental home. I knew four other all-cash buyers in the area who were looking for properties. I also knew that they would pay more than what the owner wanted. So, before signing any contract, I looked into the financial possibilities associated with the deal. This is when I came across wholesaling. I asked some industry friends for their step-by-step insight into wholesaling. Then I began reaching out to these investors.

Offering Investors A Solid Opportunity

The price for the distressed home was much lower than the common rate in the market. This drew in a lot of interest from my investor friends. I first explained to investors that the house was fully renovated in 2003, had a new roof installed in 2005, and was professionally managed by the owner. However, for maximum rental value, each unit would have to be cosmetically upgraded for a more modern feel.

I told them, “I have a property I think you might want – what would you pay if I just flipped the purchase contract to you, assuming the price leaves room for renovation costs? It needs some rehab, but not a huge amount. You would end up with a solid rental.”

Two of the investors who were looking to invest in single-family rentals in decent condition said that they wanted the property. One said he would pay me $5,000. The other said he would pay me $7,500. Both gave me a verbal commitment that they could close in 30 days, all-cash.

Signing Wholesale Purchase Agreement with Seller

I contacted the owner, walked through the property, and estimated the rehab costs a new owner would have to put in. Due to its distressed condition, I estimated the cost of repairs was $85,000. The seller’s asking price was $375,000. The estimated after repair value of the property was $550,000.

This was a good sign that there was plenty of money to be made. Assuming all went according to plan, the investor would be looking at a profit potential of $90,000.

I told the seller that I could get her a cash buyer in 30 days if she would give me an exclusive agreement. There would be no money required on her part. This meant that no mortgage approvals or banks would be involved in the deal. Since she was looking for a quick-sell, she became motivated by hearing an “all-cash buyer.” She agreed and we signed off on a wholesale purchase agreement with a contract assignment clause.

Flipping the Purchase Contract

Although it is not guaranteed, wholesaling houses often attracts willing buyers who are ready to invest. In this case study, it was my rental investor friend who was willing to pay the $7,500 wholesaling fee.

I assigned him the contract. He followed through with the seller and they closed on the deal in a matter of days. They agreed on the original asking price of $375,000.

My client paid $4,000 upfront in escrow while gathering the remaining funds. After he had amassed the rest of the funds for the purchase, I received the $7,500 directly into my account.

Lessons Learned

In a matter of several weeks, I had earned $7,500 through wholesaling real estate property. The seller quickly unloaded her inherited property, the investor closed on an attractive offer, and I earned a handsome share of the profits. Here are some of the lessons I learned while wholesaling houses:

- Referral deals always turn out best (lawyers and CPAs seem to be the best source). I wouldn’t have gotten this deal if my friend wasn’t a lawyer. He also wouldn’t have passed on a bad deal to anybody, because he cares about his professional integrity. It pays to build relationships with professionals.

- I couldn’t afford the property at the time, but I saw it was probably a good deal. I figured that I could make a bit of profit and solidify my relationships with other landlords I knew by playing the middle man as a wholesaler. The #1 thing I’ve learned in real estate is to be flexible and find a way to make a buck. This opportunity paid off big-time! I not only made $7500 with little effort, but I helped my attorney friend and his client. I also ended up doing three more deals with the buyer in the last five years.

- This deal worked out perfectly and took me very little work, although wholesaling deals rarely go this smoothly!

Back to Wholesaling Houses | NEXT: Where to Find Properties for Wholesaling?